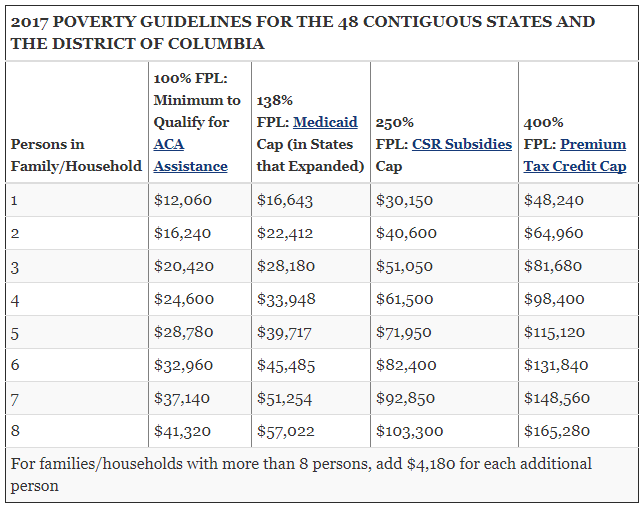

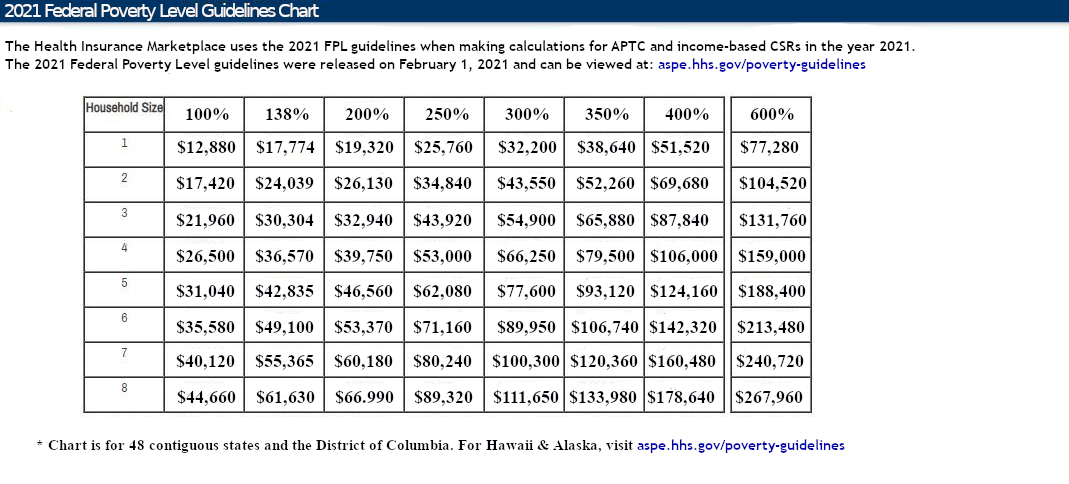

On March 11, 2021, the $1.9 Trillion “American Rescue Plan” became Public law 117-2 and on March 23, 2021, C.M.S. extended the COVID-19 S.E.P. – Special Enrollment Period – all the way until August 15, 2021. This means that the health insurance exchanges are now open to all applicants from February 15, 2021 to August 15, 2021. The American Rescue Plan not only makes A.P.T.C.s – Advance Premium Tax Credits – (“Obamacare subsidies”) available to millions of Americans who were not previously eligible but it also reduces premiums substantially (retroactive to January 1, 2021) for those who are already receiving an A.P.T.C. Currently, those who earn more 138% of the F.P.L. – Federal Poverty Level – and less than 400% of the F.P.L. are eligible for A.P.T.C.s. Those who make less than 250% of the F.P.L. are also eligible for C.S.R. – Cost Sharing Reductions. C.S.R.s dramatically decrease health plan deductibles and maximum O.O.P. – Out Of Pocket – expenses on Silver level health plans. Use the chart below to determine what those numbers look like in dollars and cents:

Real world implications:

The increased eligibility for A.P.T.C.s is not a small increase. It is the largest increase in federal health insurance subsidies for those who purchase Individual health insurance in U.S. history. The “American Rescue Plan” more than doubles the “subsidy cliff” (the point where one can no longer qualify for A.P.T.C.s) and in fact nearly eliminates it. Whilst these dramatic changes are not permanent (yet) they do apply retroactively (back to January 1, 2021) for those already receiving A.P.T.C.s and C.S.R.s and will also apply to those seeking Individual health insurance in 2022. To see if you qualify for enhanced subsidy amounts click the graphic below:

Presuming the K.F.F. calculator is correct, a couple living in Chicago age 60 and 59 (with no dependent children) and an annual M.A.G.I – Modified Adjusted Gross Income – as high as $202,000 can now qualify for an A.P.T.C. (albeit a small one). That equates to 1,172% above the Federal Poverty Level. Before the “American Rescue Plan”, that same couple would not have qualified for a subsidy if their M.A.G.I. was higher than 400% of the F.P.L. which is $69,680.

As you can see, the aforementioned “subsidy cliff” has been eliminated for all intents and purposes. More importantly though, since the median household income in Chicago is $57,238 and the median household income across the entire United States is $61,937, millions more will now qualify for much larger federal health insurance subsidies. In fact, that same couple who would have been barred from receiving a health insurance subsidy this month will qualify next month for a monthly A.P.T.C. of $949. That then reduces the monthly premium required for that couple from $1,707.97 to a much more affordable $758.97. They would save even more with the Blue Cross Individual HMO plans but unlike the PPO plans, the HMO plans are not accepted at our Teaching hospitals like Northwestern Memorial nor are they accepted at out of state Teaching hospitals like the MAYO clinic. Only the PPO plans include the “Blue Card” travel provision which allows you to travel to out of state hospitals for elective care.

Using another example. Assume a family of four living in Chicagoland – two parents age 46 and 45 with two children (age 20 and 19) – earns $75,000 in annual M.A.G.I. This month (March 2021) they would have qualified for a much smaller A.P.T.C. of only $789 but next month they will qualify for a monthly A.P.T.C of $1,037. That will then reduce their cost for the aforementioned lowest priced Bronze PPO plan from $1,641 monthly to only $604 monthly.

Basically for a two year period from January 1, 2021 (via retroactive reimbursement for existing policyholders) through December 31, 2022, no one eligible for subsidies will pay more than 8.5% of their M.A.G.I. – Modified Adjusted Gross Income – for health insurance if they choose the second lowest cost Silver plan available in their area. Many will pay much less than 8.5% depending on where their income falls within the F.P.L. – Federal Poverty Level chart above. For example, if your 2021 estimated M.A.G.I. is between 138% and 200% of the F.P.L. you will pay no more than 2% of your income for health insurance. If you’re between 200% and 250% of F.P.L. you will pay no more than 4% of your income. If you’re between 250% and 300% of F.P.L. you will pay no more than 6% if your income. If you’re between 300% and 400% of F.P.L. you will pay no more than 8.5% and (this changes everything) if your income is much higher than 400% of the F.P.L., you will still only pay 8.5% of your income for health insurance. That last part effectively ends the “subsidy cliff”.

All of these percentages are retroactive back to the start of 2021, even though the subsidy amounts won’t start to show up on HealthCare.gov until April 1, 2021, and won’t be automatically adjusted for current enrollees (they’ll have to log back into the exchange to resubmit their enrollment and get the new subsidy amount to update in real-time). Any additional premium tax credits can be claimed when marketplace enrollees file their 2021 tax returns.

How many more insured and at what cost to the taxpayer?

According to the Kaiser Family Foundation, “these additional subsidies could yield substantially lower premium payments for the vast majority of the nearly 15 million uninsured people who are eligible to buy on the Marketplace and the nearly 14 million people already insured on the individual market.” The CBO also estimates an additional 2.5 million more people will obtain health insurance subsidies by the end of 2023. All of which would not have qualified for subsidies before. The projected cost to the taxpayer according to the CBO – Congressional Budget Office and the J.C.T. – Joint Committee on Taxation – will be an increase in federal deficits by $34.2 billion over ten years (including an increase in direct federal spending of $22.0 billion and a reduction in revenues of $12.2 billion).

The I.R.S. “claw back” is eliminated for tax year 2020.

One of the most stressful components of obtaining a health insurance subsidy is worrying about what your actual income will be once more than a year passes after you initially estimated your income when you applied via the Marketplace. This happens because the subsidy you obtain is based upon the year in which you take it. And, those who apply for Individual health insurance during the annual ACA (Obamacare) open enrollment period apply between November 1st and December 15th of each calendar year. The income they are estimating at that juncture is how much they expect to earn by the end of the following year. Without a crystal ball, that is very difficult to do. If you end up earning more than you estimated, you will owe the difference back to our dear friends at the I.R.S. and, if you make more than the “subsidy cliff” amount (which until next month is 400% above the Federal Poverty Level) you owe it all back to the I.R.S. This is the aforementioned “I.R.S. claw back” provision. For many who were incorrect in their initial assumptions, this has led to shockingly large amounts owed back to the I.R.S. when their taxes are finally completed. For tax year 2020, there will be no “claw back” provision. If you were wrong on your estimates and you made more, there will be no ramifications. You will not owe the difference back to the I.R.S. regardless of your actual income level.

100% taxpayer subsidized COBRA premiums for 6 months.

For those eligible for COBRA continuation coverage after an involuntarily termination of employment or a reduction in hours worked, taxpayers will now subsidize their COBRA premiums at 100% from April 1st to September 30th via an “advance refundable payroll tax credit”. The CBO estimates that an additional 3 million people will take advantage of this new subsidy. Additional billions in costs to the taxpayer for this new subsidy are outlined by the J.C.T. here. Additional cost in time and labor to the employer who now must comply with not only developing and delivering updated COBRA election paperwork but facilitating COBRA premium collection and administration for their former employees is immeasurable at this juncture. Most especially because the COBRA subsidy is also available to those who have already enrolled in COBRA more than a year ago!

Ensuring subsidies for those eligible for unemployment.

Those who are eligible for unemployment benefits, will no longer be barred from obtaining health insurance subsidies due to their income being too low to qualify. After providing proof that they are eligible for unemployment benefits, the changes soon to be enacted under the “American Rescue Plan” ensure that they will qualify for not only the maximum A.P.T.C. but also the maximum C.S.R. if they choose a Silver level plan. The means they will pay the lowest possible premium and will have the smallest deductibles and copays as well as the lowest possible O.O.P. – Out Of Pocket – expense exposure.

Neither Healthcare.gov nor State exchanges are ready yet.

As of today’s date (03/14/2021) neither Healthcare.gov nor our state based exchanges have implemented these changes. So, you cannot obtain actual pricing that reflects these changes as of yet but you can use the aforementioned Kaiser calculator to determine an estimate of what your monthly premium will be if you purchase a Silver level plan. Bronze plans are of course even less expensive because the deductibles are much higher. Since the changes under the “American Rescue Plan” are slated to begin on April 1, 2021, Healthcare.gov, state exchanges and insurance companies will need time to comply. Once they have adjusted their quoting platforms you will be able to see actual prices and purchase the plan of your choice (or update your existing subsidy amount) by using this link.

04/28/2021 UPDATE: “American Families Plan” makes enhanced subsidies under American Rescue Plan PERMANENT.

On April 28, 2021 the Biden administration revealed details pertaining to the new “American Families Plan“. This additional spending bill will make the enhanced subsidies under the American Rescue Plan permanent.

Below is a replay of my discussion with Dan Proft and Amy Jacobson on Chicago’s Morning Answer pertaining to the changes coming to the ACA via the “American Rescue Plan” – 03/16/2021.